What is Meteora?

Meteora is a DeFi project providing users with a set of tools to create dynamic liquidity pools on the Solana blockchain and supply liquidity to them.

Currently, Meteora has an active farming program for points based on the following scheme:

1 point for every $1

For every $1 of assets provided in the project’s TVL, 1 point is earned daily.

1000 points for every $1 in fees

For every $1 in earned fees, 1000 points are awarded.

A total of 10% of MET tokens is allocated for user rewards. Points can only be earned through tools like Dynamic Pools, DLMM, and Multi-token pools. More details on these will follow below.

Wealth of Choices

Meteora offers a wide range of tools. The project provides the following opportunities for liquidity providers:

DLMM Pools

DLMM (Dynamic Liquidity Market Maker) gives LPs access to dynamic fees and precise liquidity concentration in real-time. Among all the tools, they have the highest TVL (over $1 billion).

Dynamic AMM Pools

Liquidity providers can earn additional returns through lending along with traditional swap fees.

Dynamic Vaults

They optimize capital utilization by distributing assets between lending pools and ensuring returns for liquidity providers.

“Stable” Multi-token Pools

These pools combine liquidity from multiple assets into one pool, allowing LPs to diversify their assets and optimize capital utilization.

“Stable” Unpegged Pools

Designed for “unpegged assets,” these pools maintain the pegged value of assets, enhancing capital efficiency.

Meteora Navigator helps users find the best farming opportunities in DLMM.

What DLMM Brings to the Table

DLMM is a new form of concentrated liquidity market making on Solana. It is designed to simplify and stabilize the process of providing broader and deeper liquidity on Solana.

This type of pool features flexible settings that allow users to create their own strategies within different price ranges.

The Advantage of DLMM — Minimizing `Slippage`

`Slippage` is the difference between the amount a market participant expects to receive or pay and the amount they actually receive or pay due to market changes at the time the trade is executed.

Pool Fees

Each transaction passing through the pool is subject to a fee, which is determined by several parameters specific to each pool:

Base Fee

The minimum fee amount. It ranges from 0.01% to 5%.

Max Fee

The maximum fee amount.

Dynamic Fee

The current fee amount, which is determined by trading activity. It is always between the Base Fee and the Max Fee.

Protocol Fee

Meteora takes 5% of all fees.

24h Fee

The total fees earned in the pool over the last 24 hours.

What Are Bins?

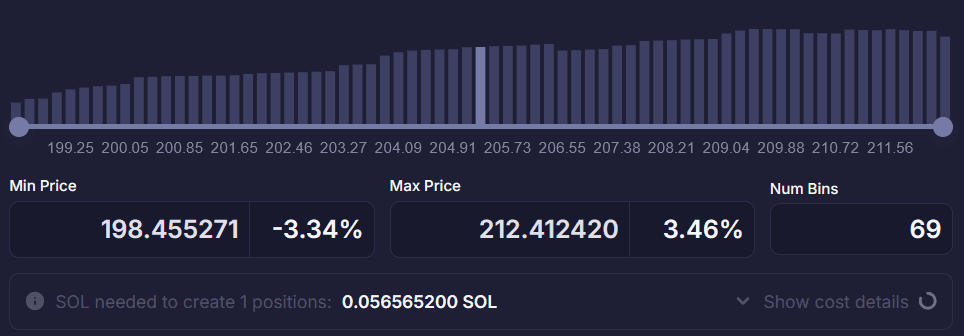

When a user creates a position in DLMM, they see the following picture (the example uses the SOL/USDC pool with a bin step 10 and a base fee 0.01%):

The “bars” in the image above represent “bins.” Each bin represents a set of liquidity within a specific price range. A position in the pool can contain a maximum of 69 bins. In this case, there are exactly that many in the price range from $198.455271 per SOL to $212.412420 per SOL.

When creating a position in the pool, you can choose how many bins will be in it.

Bin Size and the Bin Step Parameter

Pools vary in “bin size.” The size is determined by the Bin Step parameter, which can be different: 1, 5, 8, 10, 16, 20, 80, 100, 125, 200, 250, 400.

A pool with the highest Bin Step of 400 covers the largest price movement (a 1339.68% increase or a 93.05% decrease when opening a position with only one asset from the pair). Meanwhile, a Bin Step of 1 concentrates more bins within a smaller price range.

If a position is opened with only one asset from the pair, the maximum increase or decrease may be 0.68%.

Tools

DLMM provides several tools that users can choose from to distribute their liquidity in different ways:Spot, Curve, and Bid Ask.

Spot

This tool distributes liquidity evenly across all “bins” in the selected price range. It ensures uniform commission farming throughout the price movement in the range.

Bid Ask

Most of the liquidity concentrates at the edges of the range (or at one edge if the position is opened using only one asset from the pair).

Curve

Most of the liquidity concentrates around values that are closest to the current price.

❖ Where Does the Income Come From?

When someone swaps a token for which you provide liquidity, the token exchange may go through your pool, and you will be rewarded with a commission based on the volumes passing through the pool.Jupiter is a router that redirects transactions to various liquidity providers that can offer the best conditions.

What’s Important to Understand:

- Pay attention to the volume passing through the pool. The higher the volume, the more commissions you will receive.

- Each pool on Dexscreener has its own page.

- The more concentrated your liquidity in a smaller volume, the more commissions you can earn while the price moves within your range.

- You earn a commission when the price moves from one bin to another. The less volatile the price movement, the smaller the BinStep you need to use.

- Pay attention to the Base Fee — this is the lower relative fee you will receive from the pool. As the pool’s load increases, the earned commission rises to the Dynamic Fee values.

BinStep and BaseFee Ratio

The BinStep and BaseFee ratio can vary, but typically when launching a token, everyone will start with pools having higher BinStep and BaseFee and gradually move to smaller ones over time:

BinStep 250 + BaseFee 5 → BinStep 100 + BaseFee 2 → BinStep 80 + BaseFee 1 → BinStep 20 + BaseFee 0.2

In addition to having good volumes in the pool, it’s important to find good entry points. Entering at the peak of the chart and choosing the wrong strategy can result in significant losses in price.

❖ Impermanent Loss (IL)

If you are in a position with SPOT 50% Solana and 50% Token and the price moves down, the number of tokens in your position will increase, while the amount of Solana will decrease. Since the token’s price drops, the total Solana position will also decrease, leading to a loss.

Thus, even after earning good commissions in the pool, you may end up with overall losses in your position due to changes in the token`s market price.

What to Pay Attention To

Pay attention to the entry and exit points. It`s crucial to consider market dynamics and strategy to minimize risks and avoid impermanent losses.

❖ Where to Find a Pool?

The most universal and simple way to find pools is through the bot Meteora Pools Selector.

The bot allows you to configure all parameters (FDV, TVL, Dynamic Fee, Volume, and others) to suit your needs without spending all your free time staring at the screen searching for pools.

Even if you monitor pools all day, it`s quite hard to get in on time when multiple pools appear simultaneously.

Additional Resources:

Once you`ve found a good pool with a low TVL and good volumes, don’t get too excited. You still need to perform pool analytics. This is especially important during market lulls, when tokens are few and many of them only last for a few hours.

❖ Next Article

There will be a separate article on how to perform token analytics! Stay tuned for our updates so you don`t miss important information.

❖ How to Ensure Transactions Go Smoothly

In the top-right corner of the Meteora website, change the Priority Level to Turbo or Ultra. Depending on this setting, a different transaction fee will be applied.

You can also adjust the Liquidity Slippage to 5%, and sometimes even 10%. This value determines the maximum price shift at which the position will open.